M Online Banking

Microsoft Internet Explorer 6.0 is no longer compatible with Online Banking. To ensure maximum security and the best experience, please:

Manage your banking online or via your mobile device at wellsfargo.com. With Wells Fargo Online® Banking, access your checking, savings and other accounts, pay bills online, monitor spending & more. Bank with BMO Harris, we are here to help. Explore our banking, mortgage and investment products. Enroll today for online banking with BMO Harris Bank. Wherever you go, take mBank with you. Using our online and mobile applications, you can access your account anywhere, making your remote banking experience easier and more efficient. With 28 branch locations across Michigan and Northern Wisconsin, we’re never far away.

- Go to the Internet Explorer, Firefox or Chrome websites and download a new browser version

- Review Online Banking system requirements, options for access, notices and disclosures

- Once you have finished, you will need to restart your computer and sign back into Online Banking

Online Banking and eCommunications System Requirements

When you first enrolled in Online Banking, you agreed to receive certain Online Banking notices, disclosures and communications ('eCommunications'). Please refer to your Online Banking enrollment documents for a list of these eCommunications. While you may be able to access Online Banking and eCommunications using other hardware and software, your personal computer needs to support the following requirements:

Bank with BMO Harris, we are here to help. Explore our banking, mortgage and investment products. Enroll today for online banking with BMO Harris Bank.

- An operating system, such as:

- Windows NT, 2000, ME, XP, Vista or Win 7; or

- Mac OS 10

- Access to the internet and an internet browser which supports HTML 4.0 and 128bit SSL encryption and Javascript enabled, such as:

- For Windows NT, 2000, ME, XP, Vista, or Win 7

- Microsoft Internet Explorer 7.0 and higher

- Firefox 3 and higher

- Chrome 3.0 and higher

- For Macintosh using OS 10.x

- Safari 3.0 and higher

- Firefox 3 and higher

- Chrome 4.0 and higher

- For Windows NT, 2000, ME, XP, Vista, or Win 7

Most eCommunications provided within Online Banking or at other Bank of America websites are provided either in HTML and/or PDF format. For eCommunications provided in PDF format, Adobe Acrobat Reader 6.0 or later versions is required. A free copy of Adobe Acrobat Reader may be obtained from the Adobe website at www.adobe.com.

In certain circumstances, some eCommunications may be provided by e-mail. You are responsible for providing us with a valid e-mail address to accept delivery of eCommunications.

To print or download eCommunications you must have a printer connected to your computer or sufficient hard-drive space (approximately 1 MB) to store the eCommunications.

Withdrawing Consent to eCommunications and Effect on Online Banking Access

Subject to applicable law, you have the right to withdraw your consent to receiving eCommunications by calling the appropriate toll-free customer service phone numbers listed on the Customer Service tab. You will not be charged a fee for withdrawal of your consent.

If you withdraw your consent, we may stop providing you with eCommunications electronically and we may terminate your Online Banking access. Your withdrawal of consent is effective only after you have communicated your withdrawal to Bank of America by calling the appropriate customer service phone numbers and Bank of America has had a reasonable period of time to act upon your withdrawal. Your consent shall remain in force until withdrawn in the manner provided in this section.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

- Overview

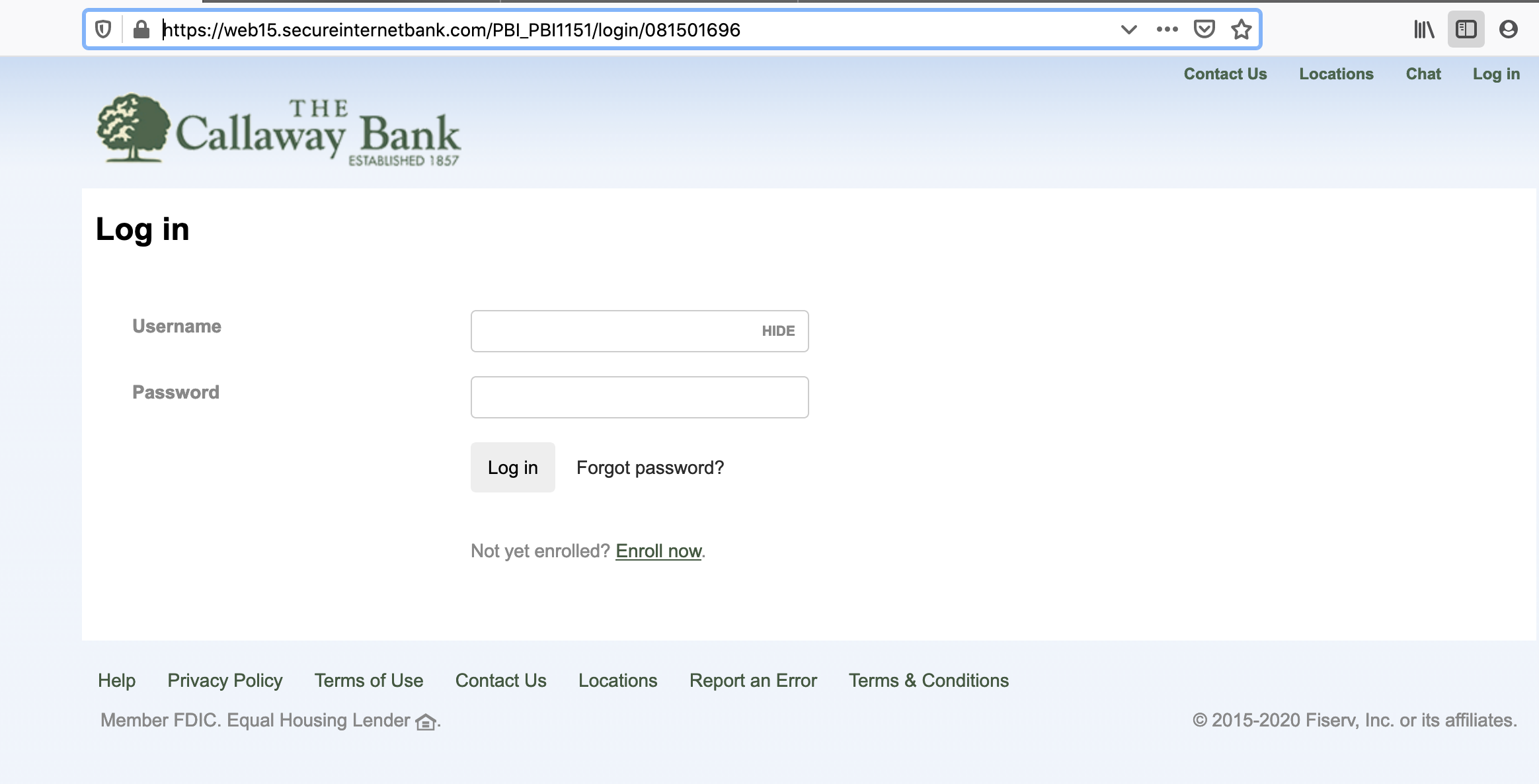

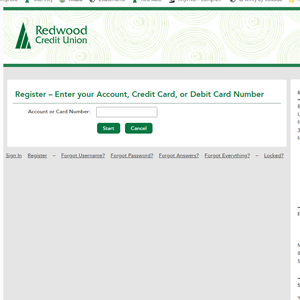

- Enroll

- FAQs

- Resources

- Open an account

- Refer a friend

Online Banking FAQs

How do I transfer money online?

Sign in to your chase.com account and choose “Transfer money” under “Pay & transfer” on the navigation menu. Choose “Schedule transfer” and then choose the account that you want to make the transfer “From.” Then choose the account you're transferring the money “To.” You can do a one-time transfer or set up customized repeating transfers. Choose a transfer date and choose “Next.” Review the transfer details and choose “Transfer Money” if the information is correct. Then you’ll see a confirmation page with a transaction number for your reference. Please review to verify the information is correct before choosing “Submit Transfer.”

How do I access my account information and activity?

expand

expandSign in to your chase.com account and choose the account that you would like to see. The Account Activity page displays your payment and deposit information with your present and available balances at the top of the page. For check details, choose the check icon next to the transaction. You can see both the front and back of your checks. To print a copy of the check, choose the “Print Check Details” icon in the top right corner of the page. To verify that you’ve received a deposit, go to the Account Activity page and choose the check icon next to the transaction to see the deposit details. To print a copy, choose the “Print Deposit Details” icon in the top right corner of the page.

How do I make a payment?

Sign in to Chase Online℠ and choose “Pay & transfer” then “Pay Bills” in the navigation menu. Choose your payee, enter the amount, “Pay from” account and the “Send on” or “Deliver by” date, then choose “Pay This Bill.” Review your payment information and if everything is correct, choose “Pay It.” Then you’ll see your payment confirmation. If you're paying a private individual rather than a business, consider using Chase QuickPay® with Zelle®.

What security features are in place to protect my account information online?

expandChase Online Banking uses encryption methods to protect your personal information like user IDs, passwords and account information over the Internet. The security of your personal information is always a priority at Chase. For more information on how we protect you, please go to the Chase Security Center.

Have more questions?

24/7 access to deposit funds

- Chase QuickDeposit℠ — Securely deposit checks from almost anywhere.

- Chase ATMs — Conveniently deposit up to 30 checks and cash at most ATMs.

- Direct deposit — Automatically deposit paychecks.

F&m Online Banking Lodi

Pay bills quickly & conveniently

- Online Bill Pay — Pay rent, mortgage, utilities, credit cards, auto and other bills.

- Chase QuickPay® with Zelle® — Send and receive money from almost anyone with just a mobile number or email address.

Helpful technology that saves you time and keeps you in the know

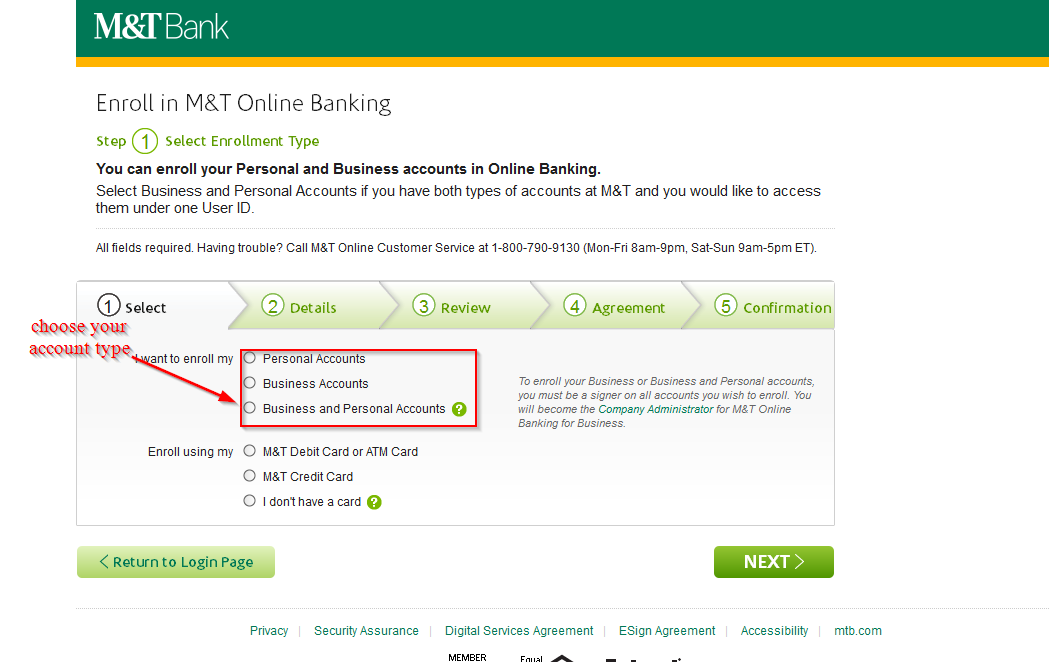

M&t Online Banking

- Paperless statements — Digitally access up to 7 years of statements.

- Account alerts — Monitor finances, avoid overdrafts and more.

- Chase text banking — Check balances and transaction history with a text.